Business Owner / Key Person

Every successful Organisation depends completely on the skill and competence of its main Key-Person/Owner for its profitability. He alone Conc eives ideas, Gathers men, materials and money, Produces goods and services, Achieves sales and collection targets, Makes profit for self and reinvestment and Plans expansion to exceed the goals.

You have definite plans for this year, next five years and next ten years – where you wish your Organisation to reach.

Every businessman believes that it is important to reach the top, more important to stay there, and most important to keep on flourishing – never to meet any setback.

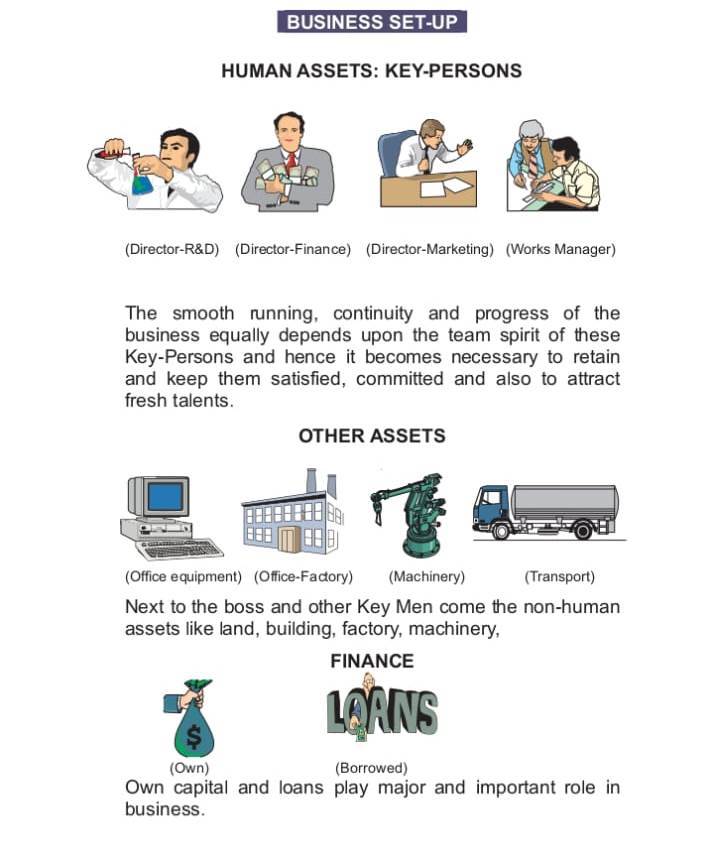

The smooth running, continuity and progress of the business equally depends upon the team spirit of these Key-Persons and hence it becomes necessary to retain and keep them satisfied, committed and also to attract fresh talents.

Next to the boss and other Key Men come the non-human assets like land, building, factory, machinery.

Own capital and loans play major and important role in business.